Supporting Tax Professionals in Starting and Growing Their Service Bureau

Register For our Webinar

Need Extra Cash?

What They Don't Want You To Know In The Tax Industry!

What Is A Service Bureau?

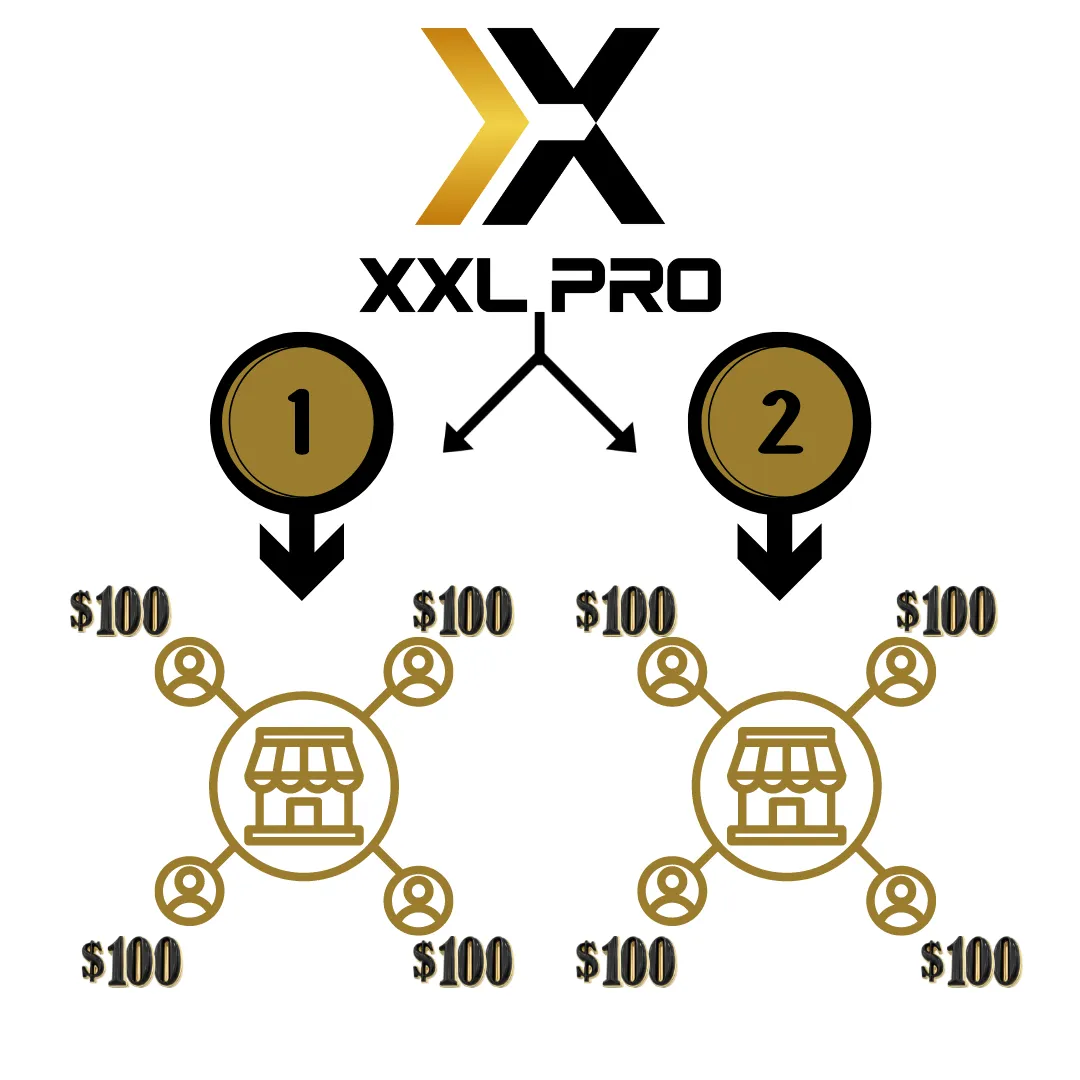

In the tax preparation industry, a Tax Service Bureau functions as a business model, allowing you to provide customized branded software to other tax professionals.

Typically, Service Bureaus offer supplementary services such as technical support, customer service, and aid in software user bank onboarding.

For tax professionals utilizing tax software, managing your software and related fees could lead to significant annual savings reaching thousands of dollars.

THE MOST PROFITABLE BUSINESS MODEL IN THE TAX INDUSTRY

SHOW ME THE MONEY

Transitioning to a Service Bureau can be a lucrative business model in the industry, providing multiple revenue streams and opportunities to increase earnings during quieter times. Here are some common methods Service Bureaus employ to generate income:

Service Bureau Fees

Each bank product funded through your software results in a "Service Bureau Fee" paid directly to you as the Service Bureau in real-time by the customer.

"UPFRONT" INCOME

Generate instant revenue by offering Service Bureau Packages, which include software licenses, CRM, Tax Map Workbook, E-book, Marketing Bundles, Contracts or Tax Academy access. Take advantage of the available training and resources to optimize revenue generation.

ADD ON FEES

Besides Service Bureau Fees, you can also utilize other fees paid by customers, including Technology & Transmission Fees, Service Bank Fees, Audit Protection Fees, and Add-on Fees. We offer detailed training on how to effectively incorporate these fees into your Service Bureau, and they are typically paid to you in the first week of July.

RENEWAL INCOME

Once you've sold your software to someone, you have the option to charge them an annual fee (which we strongly recommend). For instance, if you make a goal to sell your software to 20 people and charge a $1,000 renewal fee, you could collect $20,000 the following year without needing to make any new sales.

WHO ARE WE AT XXL Tax Pro Solutions LLC?

We’ve Created A Beginner/Existing -Friendly Mentorship To Help You Grow and Scale Your Business

© Copyright 2024. Lopez Consulting LLC. All rights reserved.

2022 All Rights Reserved.